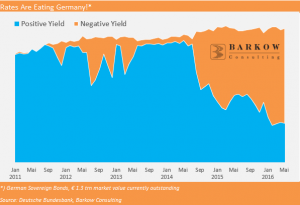

Rates Are Eating Germany

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

There has been a lot of stir about a chart created by strategists at Bank of America Merrill Lynch, which shows that 25% of global sovereign bonds are trading on negative yields!

We have checked for Germany and would say:

This a very envidiable situation! Currently > 70% of German sovereign debt are generating cash for minister Schäuble instead of for investors/savers.

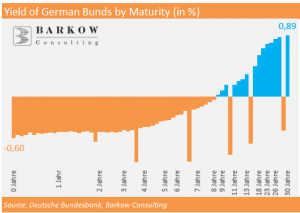

Further, German Bunds carrying a positive yield have a remaining maturity of at least 8 years and 8 months.