German FinTech VC 2018: Breaking Through €1bn Mark

Peter Barkow – For Free Updates on Startups, VC & FinTech Sign Up >> HERE

German FinTech Investments 2018: Breaking Through €1bn Mark

The state of global FinTech VC is subject to continuous debate. While international data points for 2018 are not yet out, we review German numbers below:

- Record Quarter

- Record Year

- More Than €1bn Invested

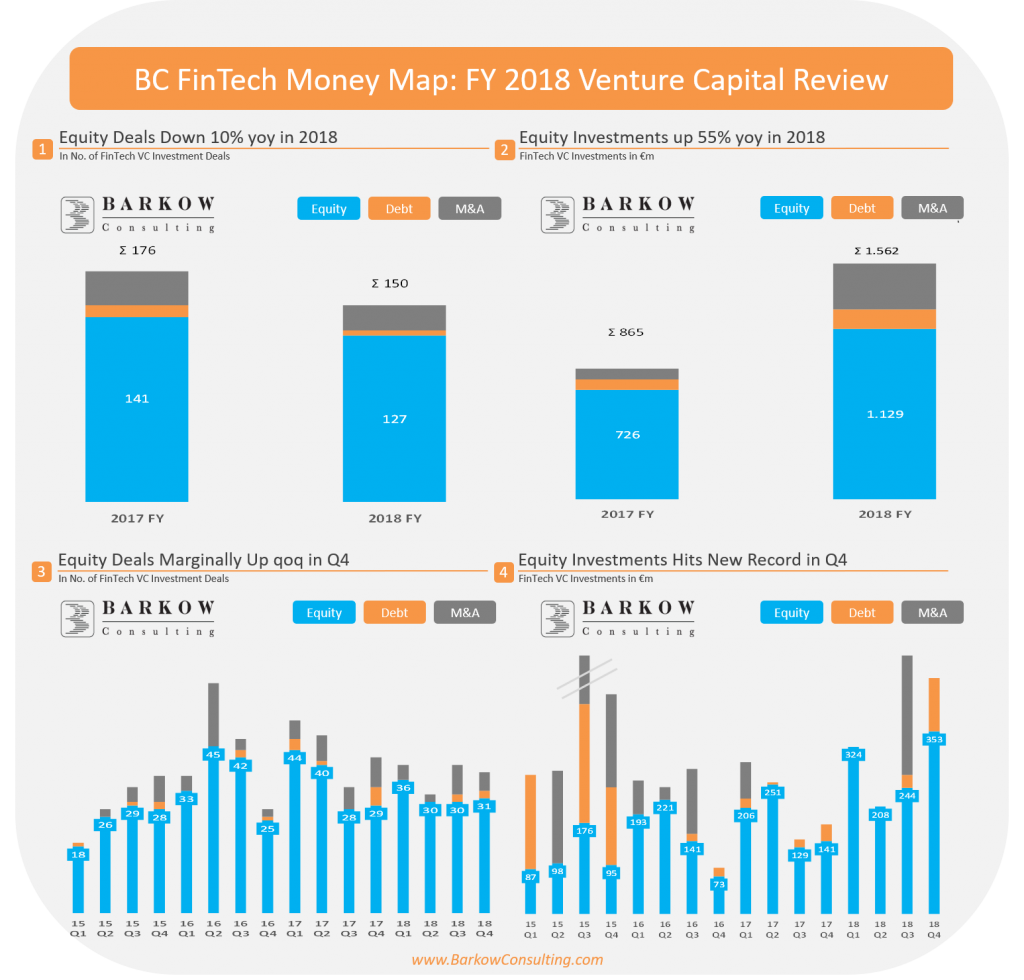

FY 2018 – More Than €1bn Invested For The 1st Time

- Equity VC investments came in at €1.1bn

- Reaching a new record high and exceeding the €1bn mark of the first time

- Equity VC investment growth accelerated to 55% yoy after two years of slowing momentum (2017: 16% yoy, 2016: +38% yoy, 2015: +145% yoy)

- Number of equity VC deals declined by 10% yoy to 127, revisions throughout the year are likely to push the number higher, however

- Funding environment getting tougher still: Ratio of equity VC deals to number of Startups declined markedly from 20% in 2017 to 16% in 2018

- Top 10 deals accounted for more than half of German FinTech equity VC (53% or €594m)

- The largest deal (N26) alone was worth 12% of German FinTech equity VC or €130m

- FinTech represents almost a third or 29% of all German equity Venture Capital

Q4 2018 – A Record Quarter

- Equity VC investments hit a new record high in Q4 at €353m up 45% qoq and more than doubling over Q4 2017

- Number of equity VC deals in Q4 came in at 31 hardly changed qoq and yoy, the quarterly average since 2012 stands at 32 deals

- We count 13 large deals in Q4 with a funding volume at or above €10m

- Top Deals: Tado, Finleap, NavVis, Element, Price f(x) and xbAV