CrowdInvesting: What’s Needed to Grow Up?

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

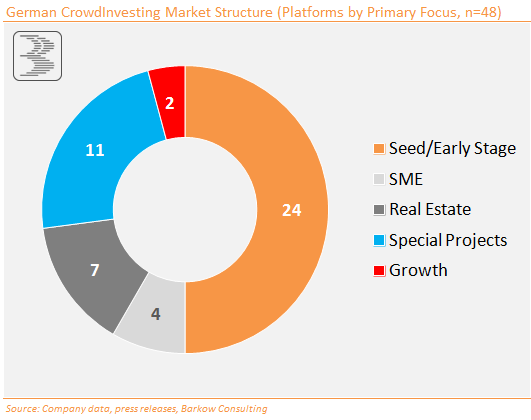

On 26 May I had the honor of talking about the current state of the CrowdFunding industry in Germany at HSBA’s V. Finance Conference in Hamburg.

To download my presentation please click >> HERE

Subsequently, I joined a panel to discuss what’s needed for CrowdInvesting in order to establish itself as an asset class (among other interesting things).

Please find below my highly subjective take away from the panel discussion:

- CrowdInvesting needs to prove it can produce adequate risk adjusted returns. To do so, a killer exit is required.

- Platforms need to live up to their gate keeper function, i.e. do a much harder due diligence.

- Standardised framework of Investor Communication at AND after fundraising campaign needs to be developed.

- Platforms need to get better in attracting a crowd. At the moment companies spend too much time and money on related marketing campaigns themselves.

- Platforms need to improve in transparency especially on defaults, but also on exits (if any).