FinTech + Politics = ?

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

For a long time we have shared our manifold and increasing concerns about Germany’s financial/banking system with all who would listen and also quite a few who would not.

Concerns range from excessive costs, low interest rates, high fragmentation, too many branches, too many deposits, suboptimal governance structures, questionable business models etc.

The final nail for financial Germany’s coffin could well be FinTech. German institutions have long ignored the challenge of digitalization (nowadays also called digitization). As late as 2015 only some German financial institutions seem to have received their FinTech wake up call. German banks are still in the early stages of our disruption cycle.

In addition, we cannot spare politicians and regulators from our growing concerns. To our knowledge, there is literally no serious FinTech initiative in Germany led by politicians, federal representatives or financial watch dogs.

At the same time political and official bodies in the UK are pressing ahead with FinTech apparently being a top priority for both prime minister David Cameron as well as the mayor of London Boris Johnson. Both are repeatedly on record with strong pro FinTech statements. And they walk their talk …

To date we count 17 (spelled out: Seventeen!) initiatives related to FinTech the UK has already started. UK’s 17 action points are listed without particular order below:

- FCA Innovation Hub

- London City Major’s FinTech Special Envoy

- UK Government FinTech Futures Research

- Innovate Finance FinTech 2020 Manifesto

- Prime Minister Cameron backs UK FinTech 2020 manifesto

- London City Major’s FinTech Mission NYC

- London and Partners FinTech initiative

- London Tech City

- BoE Research: Innovations in payment technologies and the emergence of digital currencies

- Government Office of Science Research: Blackett review into FinTech

- Bank of England One Bank Research Agenda

- UK Trade and Investment London Inward Mission Australia

- UK Government Distributed Ledger Research Project

- Introduction of Tax Bebefits for CrowdFunding

- Mandatory SME CrowdFunding Referral Scheme

- London’s Mayor FinTech Trade Mission to Japan

- All-Party Parliamentary Group on FinTech

- FCA introduces concept for Regulatory Sandbox (Barkow Consulting: Added on 12 November 2015 after initial publication)

- The Challenger Bank High Level Advisory Group (Barkow Consulting: Added on 25 November 2015 after initial publication)

- Open API Initiative (Barkow Consulting: Added on 1 December 2015 after initial publication)

- Innovate Finance announced strategic partnership with BritishAmerican Business (Barkow Consulting: Added on 9 December 2015 after initial publication)

- FCA and Australian regulator strike fintech deal (Barkow Consulting: Added on 24 March 2016 after initial publication)

- Establishment of a FinTech panel (Barkow Consulting: Added on 11 April 2016 after initial publication)

- Establischment of Information hub for FinTechs (Barkow Consulting: Added on 11 April 2016 after initial publication)

- Building of FinTech Bridges (Barkow Consulting: Added on 11 April 2016 after initial publication)

And the UK is already successful in luring foreign FinTech companies. Two of Germany’s most prominent and best funded FinTech startups SumUp and Payleven are already regulated by the FCA and have moved a part of their operations to London. German Bitcoin company SatoshiPay has recently emigrated to London following its peer Yacuna. German challenger bank Fidor has recently started its service in the UK. Finally, German P2P-Lender Zencap has been acquired by its UK counterpart Funding Circle.

Even Australian FinTech companies Lend2Fund has decided to move its operations to London. US startup stockfuse has been lured into Barclays‘ London based accelerator programme (powered by) Techstars.

At the same time private FinTech initiatives are mushrooming in Germany. We count 15 conferences, pitch days, hackathons etc. with a focus on FinTech in the last quarter of 2015 alone.

It might be time for German politicians to follow suit!

——-

Below, we have started our list of German political FinTech actitivities:

- Frankfurt city government looks to kickstart its own Level39 (Barkow Consulting: Added on 13 November 2015 after initial publication)

- BaFin starts internal FinTech project group (Barkow Consulting: Added on 22 January 2016 after initial publication)

- German government comissions FinTech research (Barkow Consulting: Added on 25 January 2016 after initial publication)

- FinTech Barcamp workshop chaired by finance ministry (Barkow Consulting: Added on 29 February 2016 after initial publication)

——-

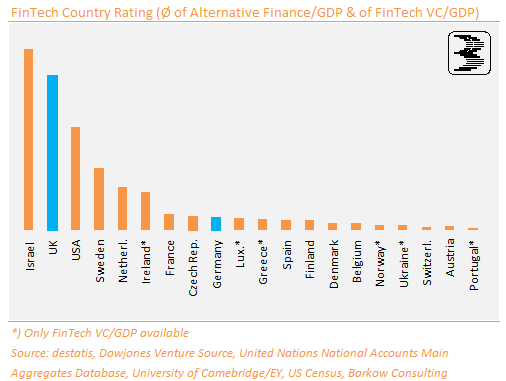

By the way: UK was already at the top of our FinTech Country Ranking in 2014, competing head to head with Israel. Germany apparently resides in FinTech No Man’s Land: