Venture Capital Crunch or Not?

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

Tech Bubble, VC Crunch – or What?

There’s lots of talk about a tech & venture capital bubble at present. Bubble talk is already around for a couple of years already. However, things seem to have heated up lately (see chart below):

Nonetheless, let’s try to recap, where we stand at present regarding the venture capital crunch debate and where it is heading:

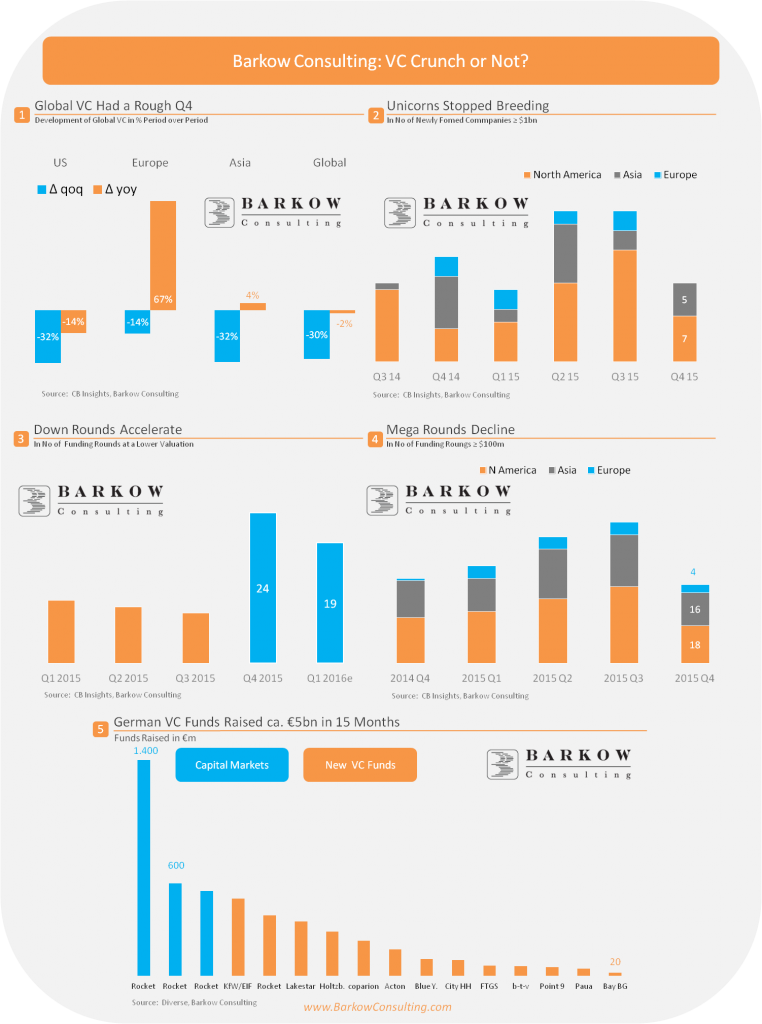

- US VC volume was down heavily in Q4 2015 (qoq but also yoy)

- European VC declined less qoq and was even up substantially yoy

- Unicorn creation was strongly down in Q4

- VC down rounds on the contrary increased substantially in Q4 2015 and Q1 2016

- Tech IPO markets were chilly last year and froze completely at the beginning of 2016, not much of a recovery since then

- Market intelligence firm Pitchbook is previewing Q1 deal count down for the 4th quarter in a row

All in all this doesn’t read very well. And we have numerous US VCs sounding alarm bells (e. g. First Round, Y Combinator) too.

Some positives as well:

- Market intelligence firm mattermark published, that global VC dollars are up 8% yoy for January/February 2016 …

- … and sees tech lay offs slowing

- Market intelligence firm Dow Jones VentureSource sees highest US fundraising activity since 2000

- Market intelligence firm Pitchbook reports a Q1 recovery for VC and median valuations up (both qoq)

- German VCs raised a whopping €5bn during the last 15 months

- Our proprietary FinTech Money Map database tells us that German FinTech VC had a strong start to the year

Our read of this is:

US VC fundraising for startups seems indeed more difficult than in 2015. Nevertheless, individual comments at micro level seem worse than macro trend data. With the majority of global unicorns due to seek new funding around year end, we will probably have to wait until then to see, if and how bad things are and can get.

Europe and especially Germany currently seem less impacted partly due to smaller deal sizes and earlier funding stages. It is, however, possible that things get trickier in Europe as well especially for larger deals.

Please click two times on below Infographic to enlarge: