Deposit Required – By Country Analysis of EU Deposit Protection Scheme

Peter Barkow | Sign Up For Our Newsletters >> HERE

Sometimes Data Comes by Surprise

As a team it is our job to continuously screen the market for underresearched financial data. And in times of Open Data, there is thankfully a whole lot of it.

Nonetheless, sometimes data comes by surprise. In this case, we received an email from a fellow business partner alerting us to EBA data on national deposit security schemes, which have been sort of sneaked into the market.

The email read:

You will probably find a treasure chest of insights buried in the data. (our translation)

And indeed the data set was a diamond in the rough. Thus, we got to work and applied our research analytics…

EU Deposit Protection: €30bn Still Missing

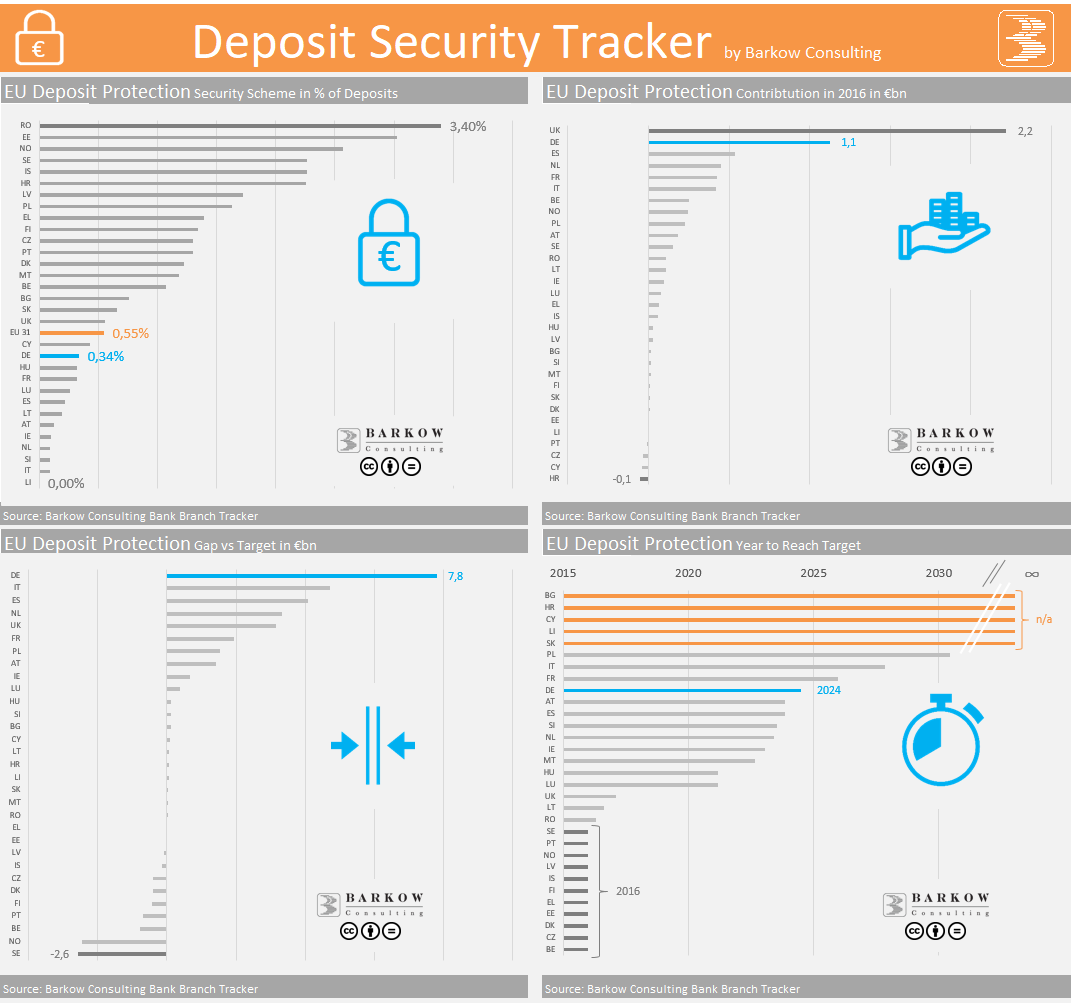

Below we have summarised our findings and crafted an infographic:

- EBA has released data for 31 countries (EU31)

- The degree of deposit protection funds (excl. voluntary national schemes) varies substantially at present: While Luxembourg has literally no funds, Romania has the highest coverage ratio of 3.4% (in % of protected funds). The average protecion ratio for EU31 is 0.55%.

- There is also a surprisingly high difference in target coverage levels. Most countries need a coverage of 0.8% of protected funds, but the number can go up t0 3.4% (for Romania). France on the other hand has the lowest coverage target at 0.5% of protected funds.

- A total €30bn are currently missing versus target coverage ratios, but banks have until 3 July 2024 to fill the gap.

- Germany has the largest gap at €7.8bn, followed by Italy (€4.7bn), Spain (€4.1bn) and the Netherlands (€3.3bn). France comes in 6th with a €1.9bn gap on a lower 0.5% target level.

- A total of €6.8bn has been added to deposit security funds in 2016, with UK Banks having contributed ca 1/3 or €2.2bn. German banks have added €1.1bn and Spanish €0.5bn. Three countries (Croatia, Portugal and the Czech Republic) withdrew money from their schemes on a net basis.

- Extraploating 2015/16 trends, 23 countries will reach their national target ratios before the July 2024 deadline. German banks will do so exactly 7 days ahead of the deadline. Admittedly, exptrapolating one years‘ trend is not a lot to hang your hat on, but that’s all the data there is at present. We will revisit numbers next year.

Reminder:

The EU requires national governments to protect deposits up to €100k regardless of respective protection funds.