EU Corp. Credit Watch August: Big Bertha Still Not Firing

Peter Barkow – For Free Corporate Finance Updates Sign Up >> HERE

We have just taken a look at Eurozone corporate loan trends for August using our proprietary EU Credit Benchmark Model®.

Model & Methodology

As outlined in our initial research note dd. 16 July 2014 Draghi‘s Dilemma: North-South-Gap Grows, we mainly watch two developments in order to measure if ECB actions are successful:

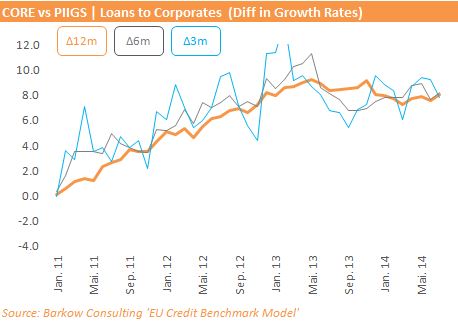

1) Growth Trends: We look at the development of various growth rates (12m, 6m, 3m) for Eurozone corporate loans, rather than just focusing on yoy-deltas, which are at the center point of ECB disclosure. In doing so, we can identify turning points in the credit cycle earlier.

2) Growth Gaps: We look at the corporate credit growth difference of selected Eurozone regions or country aggregates, of which the most important one is the Core/PIIGS differential.

Main Findings August:

– Eurozone corporate loan growth stood at -2.2% yoy in August, slightly better than July, which was revised down to -2.4% yoy.

– Short term Eurozone growth rates (6m, 3m) deteriorated for the second month in a row and currently do not indicate further improvement of yoy growth.

– PIIGS (Portugal, Ireland, Italy, Greece, Spain) corporate loans are down 6.3% pa marginally improving over July (-6.4%)

– Short term PIIGS growth rates (6m, 3m) fell strongly in August. They are now below yoy growth rates which could point to further deterioration of yoy growth

– Core/PIIGS growth gap further increased to 8.2%. In other words corporate loan growth of core countries is >8% higher than PIIGS loan growth, see chart below

=> BIG BERTHA STILL NOT FIRING!

Stay tuned to corporate finance trends with our newsletter >> Credit News