An Average Record Quarter – German FinTech VC Q1 2018

Peter Barkow – For Free Updates on Startups, VC & FinTech Sign Up >> HERE

German FinTech Investments Q1 2018: New Investment Record on Average Deal Count

We review German FinTech investment numbers for Q1 2018 below:

Q1 2018 FinTech VC Trends

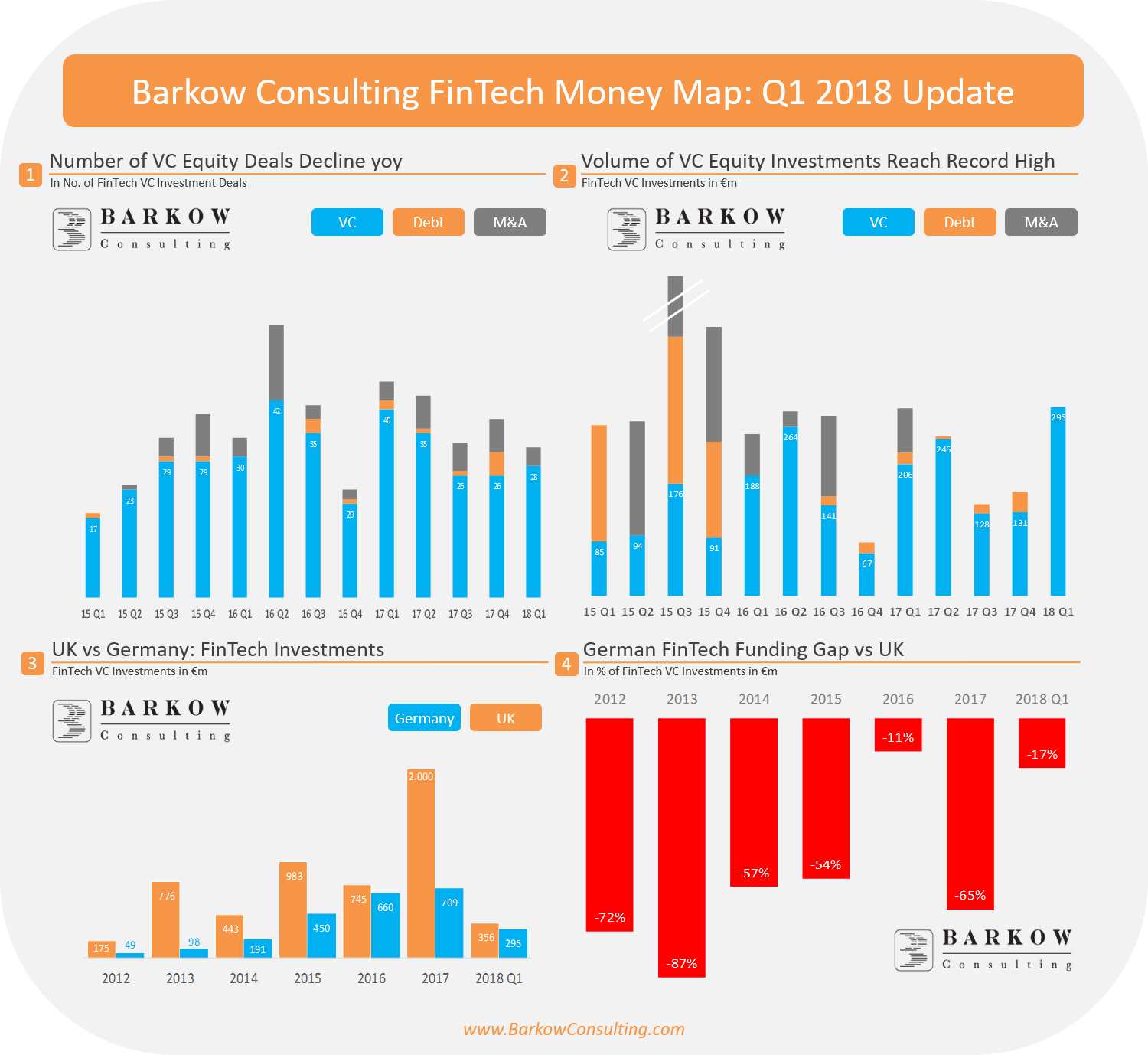

- Equity investments in Q1 reached a new record high at €295m, more than doubling qoq and up more 44% over Q1 2017, the quarterly average since 2012 is €162m, Q2 2016 was the previous record at €264m

- Number of equity deals in Q1 came in at 28, one deal lower qoq but a steep 30% decline of 30% vs Q1 2017, the latter is, however, a tough comparable benefiting from some overlay of Q4 2016, the quarterly average since 2012 stands at 29 deals

- We count 5 large deals in Q1 with a funding volume of €10m or more, three of which exceeded €50m

- Top Deals: N26 (new record holder at €130m), solaris and smava

Narrow Gap to UK

- UK FinTech startups raised €356m VC in Q1, which is a slow run rate compared to FY2017

- With that the German gap accounts for a mere 17% after a gap of 65% in FY2017

ICOs in Q1 2018 (not included in Money Map stats above)

- We observed 5 ICO announcements

- savedroid ICO successfully raised between €35m and €40m, copytrack raised €3m