How Low Do We Go? FinTech Money Map Q4 Update

Peter Barkow – For Free Updates on VC & FinTech Sign Up >> HERE

FinTech VC Currently Controversially Debated

The state of (global) FinTech VC has been subject to controversial debate for a while. We have recently looked into the first data points for FY2016 of the global FinTech sector. After a severe slowdown in Q3 the final quarter of 2016 seemed slightly more encouraging again. But this is an initial analysis and needs to be treated with care: It is based on one data provider only. Experience tells, that results of different data sources can vary substantially and even be contradictory.

BC FinTech Money Map Update: Where Do We Currently Stand in Germany?

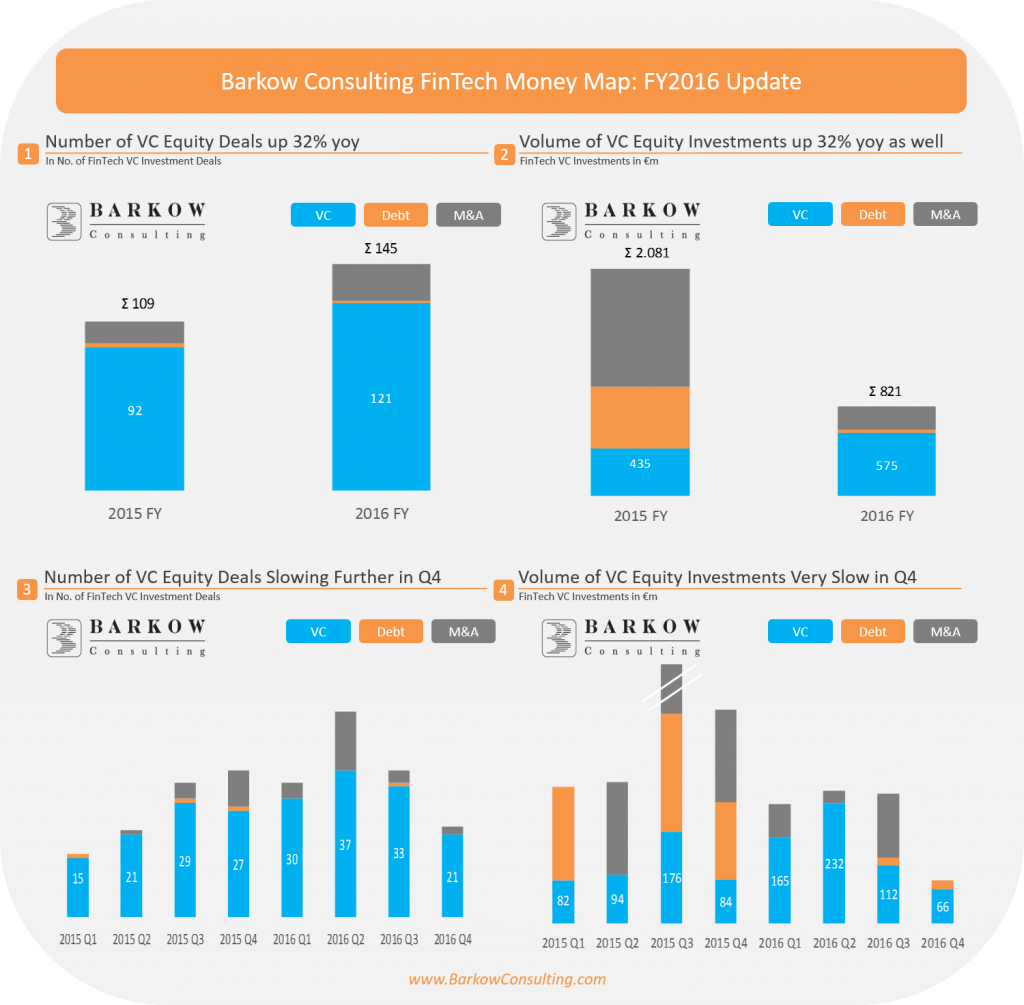

Below we share results for the German FinTech VC in FY 2016 and Q4 using our proprietary Barkow Consulting FinTech Money Map database:

- FY2016 number of equity VC deals and investment volume are both up 32% yoy. Without a doubt, these are no bad growth numbers. Nonetheless, they are also substantially below previous years figures, when both ratios doubled at least.

- Q4 2016 has been the weakest quarter of the year on any measure. Number of equity deals came in at 21 and equity investment volume at €66m. This is the weakest print since Q2 2015 (number of deals) or Q4 2014 (investment volume).

- Our Q4 2016 numbers include a seizable funding round for BillFront, which some argue to be a UK FinTech startup, despite German founders and funders. Nevertheless, it seems to us, that the German part of BillFront received the funding. Without BillFront equity VC investment volume in Q4 2016 would have been below €50m even.

- On a more positive note FY 2016 FinTech M&A deals are up 72% yoy to a total of 24.

Slowing FinTech VC Has Arrived in Germany

No doubt: 2016 ended on a weak note. There was talk about a slowdown in (FinTech) VC since the end of 2015 already. And it is no surprise, that talk needs some time to filter through to statistics. Closing a funding round can take up to 6 months, in some occasions even longer.

Finally, slowing VC seems to have hit German FinTech in Q4.

How Bad Is It Really?

For the time being, we see some mitigating factors to weak Q4 numbers:

- Q4 investment volume was extremely slow, but this was due to quite a few deals not disclosing funding volumes.

- It is hard to base a trend on one or two quarters only given the volatility of VC numbers, especially when diving into specific sectors on a regional level.

- In an environment of downrounds some deals might get carried over into Q1 2017. We have observed this for global venture capital in 2015 already, when Q4 was shockingly weak and Q1 2016 miraculously strong.

- VC data tends to get revised upwards after period end, due to late announcements of deals. Q4 2016 is therefore likely to still improve during the next weeks.

- Rising FinTech M&A indicates that strategic buyers are increasingly willing to put money to work. FinTech M&A has peaked in Q2 as well, however. Throughout the year we have also seen increased corporate VC investments in Germany.

In a nutshell: We don’t think it is too bad…

…yet.

Peter Barkow – For Free Updates on VC & FinTech Sign Up >> HERE