New Record! Last Record? | Real Estate News

Peter Barkow – For Free Updates Sign Up to Our Newsletters >> HERE

We have just published the Q4 2017 edition of our Real Estate News looking net capital inflows into German indirect property investment vehicles:

- Listed Real Estate: New Normal?

- Inst. Open-End Funds: Through the Roof

- Closed-End Funds: Comeback Continues

The complete newsletter can be downloaded…

Summary:

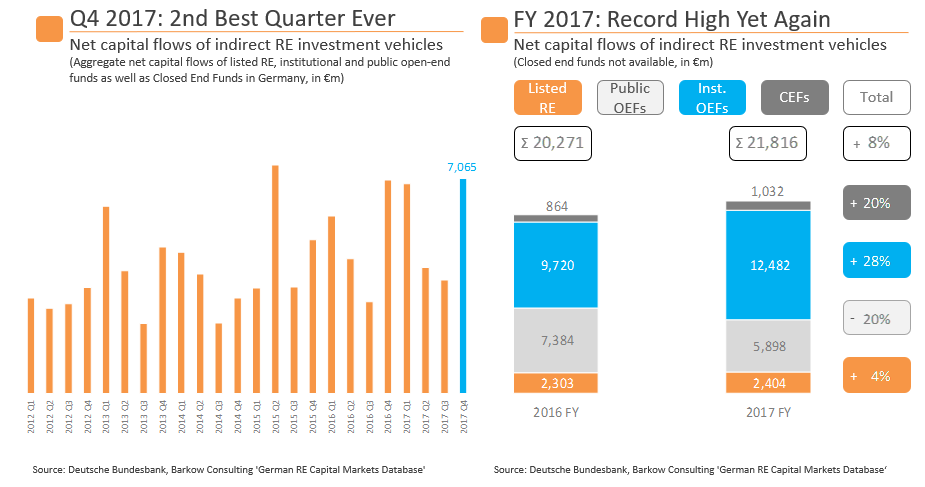

In Q4 2017 indirect real estate vehicles accounted for net capital inflows of €7.1bn up 1% yoy, making it the 2nd best quarter ever behind Q2 2015. FY 2017 came in at €21.8bn increasing by 8% yoy and reaching yet another record. Rising long term interest rates beg the question, whether we have reached the peak of the investment cycle.

(Chart 1 & 2)

Listed Real Estate inflows came in at € 0.6bn in Q4. This brings FY 2017 to €2.4bn representing a slight increase of 4% yoy. Nonetheless, Q4 inflows almost entirely consisted of one deal worth €0.5bn. With the first notable IPO in quite some time announced and alstria having raised €0.2bn already, 2018 seems off to a good start. Rising long term interest rate might be a drag on the market.

(Chart 2 & 3)

Institutional Open-end Funds increased by 28% yoy to 12.5bn for FY 2017 reaching a new record high and surpassing the €10bn markt for the first time.