Welcome Back Closed-End Funds | Real Estate News

Peter Barkow – For Free Updates on Real Estate sign up >> HERE

Dear property professional,

we have just published the Q2 edition of our Real Estate News looking at Q1 2017 net capital inflows into German indirect property investment vehicles:

- Listed Real Estate: Stabilising

- Public Open-End Funds: Normalising

- Closed-End Funds: Return of Data

The complete newsletter can be downloaded …

Summary:

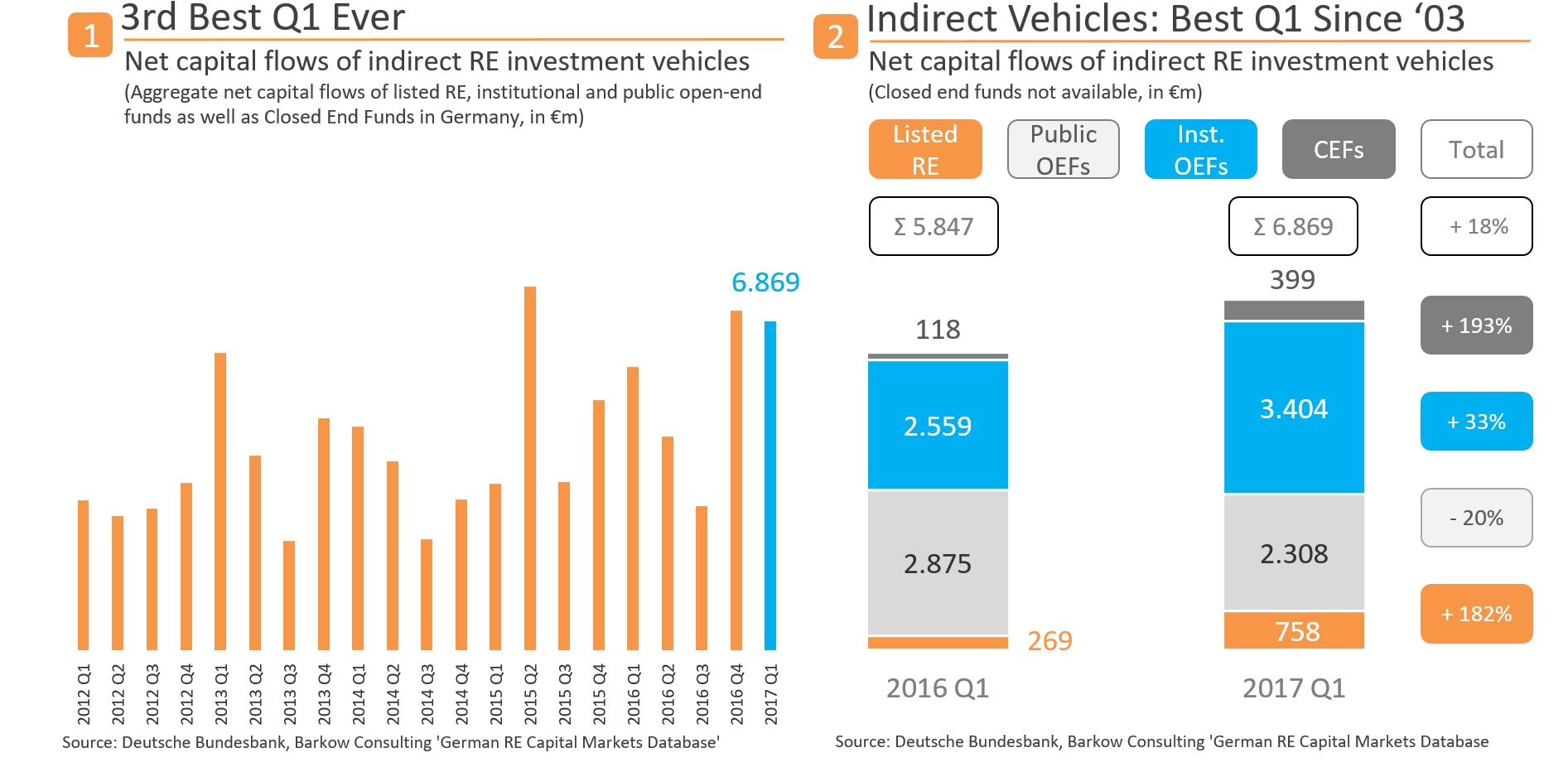

In Q1 2017 indirect real estate vehicles accounted for net capital inflows of €6.9bn up 18% yoy. The inflow number comprises listed real estate (RE), institutional open-end funds (OEFs) & public OEFs as well as closed-end funds. Q1 was the best start to a year since the financial crisis in 2008 and effectively since 2003. It’s also been the third best start to a year ever. (Chart 1 & 2)

Listed real estate inflows showed a comparatively strong start in Q1 2017 at € 0.8bn almost trippling yoy. Nonetheless, our number almost entirely consists of €0.5m capital issued by Deutsche Wohnen. The capital issue of TLG and Immofinanz’ placement of Buwog stock were other noteworthy transactions in Q1 2017 both worth around €0.1bn. (Chart 2 & 3)

According to a new data row from Deutsche Bundesbank closed-end funds attracted €399m of net new money in Q1 2017. With that the quarter was almost 3x the year ago number, which seems quite promising. (Chart 2 & 4)